Award-winning PDF software

2106 instructions 2025 Form: What You Should Know

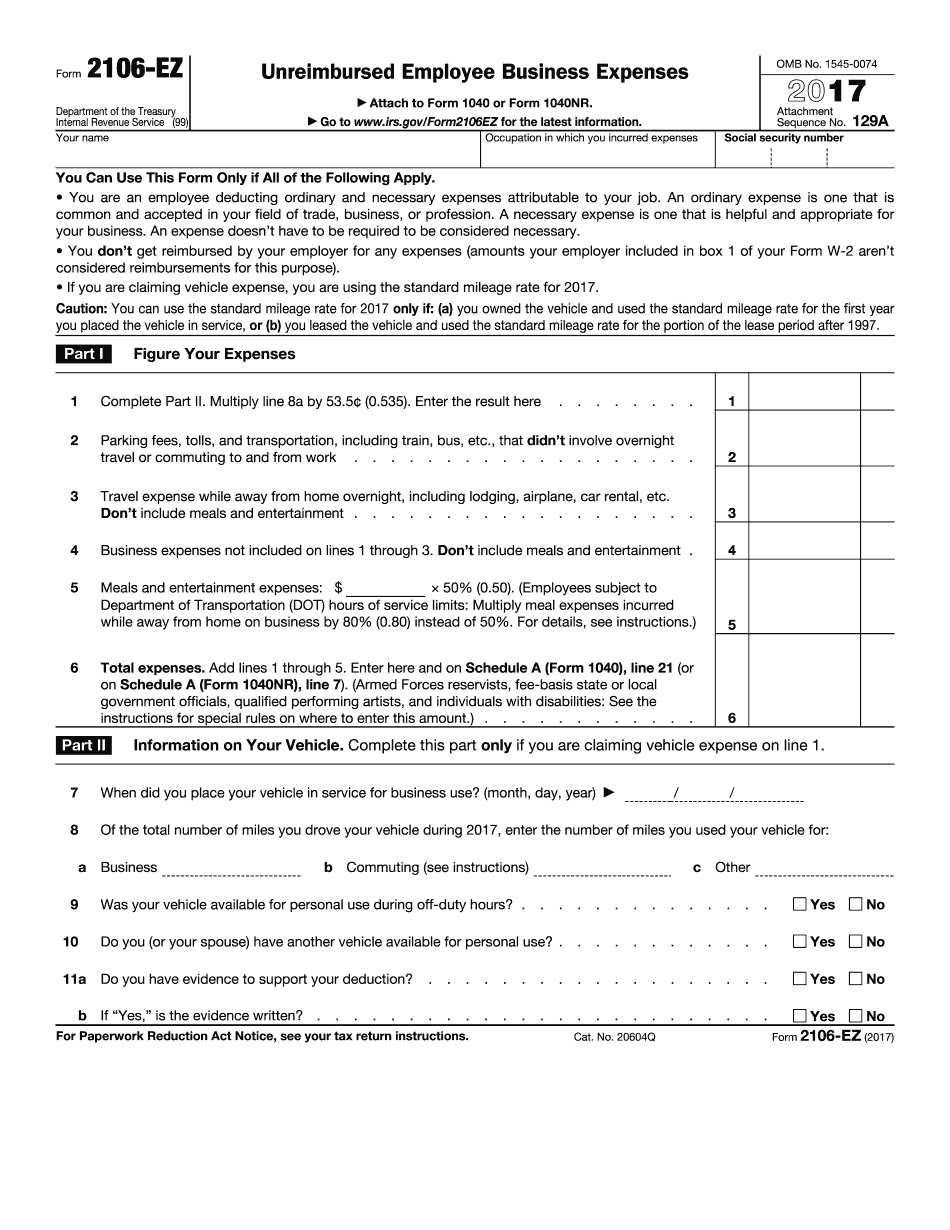

Tax Cut for Individuals and Tax Relief for the Middle Class ended on Dec 29, 2018. Jan 1, 2025 – Feb 27, 2019. Forms 2106 and 2106.1. For tax years beginning Jan 1, 2019, through Feb 27, 2019, use IRS Forms 2106 and 2106.1. The following items are deductible work-related expenses. The amount is reduced by any reimbursed expenses from other sources, such as government, insurance companies, and donations. Note If the reimbursements come from other sources, the total amount of reimbursements is taxable. For more information, see Publication 946. Instructions for Form 2106-EZ -- Reimbursed Employee Business Expenses Instructions for Form 2106-EZ — Reimbursed Employee Business Expenses What Is IRS Form 2055? — TurboT ax Tips & Products April 6, 2025 — This form is used by employees to claim non-reimbursed business expenses. Instructions for Form 2055 — Non-Reimbursed Business Activity or Expenses Instructions for Form 2055 — Non-Reimbursed Business Activity or Expenses What Is IRS Form 2064? — TurboT ax Tips & Products Instructions for Form 2064 — Tax Return Deduction For Certain Business Expenses Instructions for Form 2064 — Tax Return Deduction For Certain Business Expenses What Is IRS Form 2066? — TurboT ax Tips & Products Instructions for Form 2066 — Tax Return Deduction For Non-Reimbursed Business Expenses For Individuals. Instructions for Form 2066 -- Tax Return Deduction For Non-Reimbursed Business Expenses For Individuals. What Is IRS Form 2106P? — IRS Tips for New Taxpayers. Instructions for IRS Form 2106P. What Is IRS Form 2106-EZ? -- Reimbursed Employee Business Expenses. Instructions for IRS Form 2106-EZ. What is Federal Employee Health Benefits For Self-Employed? Federal Employee Health Benefits For Self-Employed and Employee-Participation Plans. This is a form you use if you self-employ: (a)(2)(3) or (5) to provide health benefits to your employees. The Form is filed once a year. Self-Employed Individual's Annual Report. (7)(10) What is Form 3115? — Taxpayer Identification Number. Instructions for Form 3115.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2106-EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2106-EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2106-EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2106-EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.