Award-winning PDF software

2106 Ez 2025 Form: What You Should Know

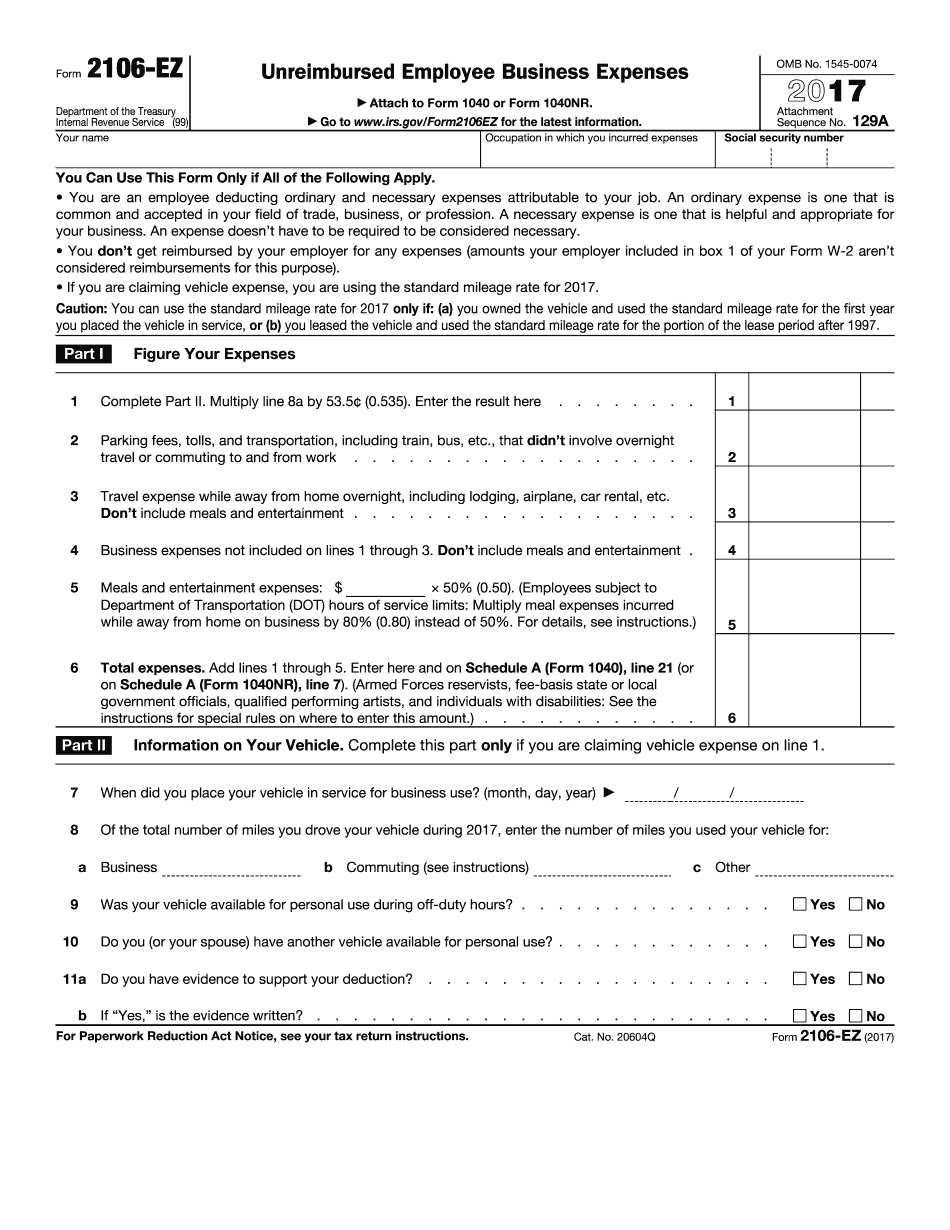

Note: When submitting a request under this form to the IRS, you should attach a copy of all of your other receipts for the same calendar year. How to claim the tax deduction for an employee expense. A common claim for making a claim of a non-reimbursed expense is that you are the primary consumer of, or the primary beneficiary in case of a legal or beneficial relationship with, the property or service in question. In this situation, the amount of any expense you incur for your use of the property or service does not depend on your status as an employee, and all expenses claimed are ordinary and necessary expenses you incur as a result of your work, whether you receive any compensation. Note: If you have more than one business or sole proprietorship or if all your income or income sources are business income, you may qualify for the more favorable tax withholding rules in some cases for employee expenses. Do you have to make a claim for a non-reimbursed expense for all the expenses your business incurs on the days you are absent from the job? No. You only have to file Form 2106 if all the following apply. • You are reporting your ordinary and necessary expenses from your day-to-day experience as an employee. • You claim the business expenses on your personal tax return. • You do not spend more than 50 percent (50%) of your time, in the calendar year, using the property or supplies or services that you use in your work, which is the amount for the preceding year. Can I file this claim with my tax return? Yes. This can be accomplished by attaching one copy of your Form 1040 tax return along with a copy of all of your Forms 2106 (if you have them) to your tax return, and also attaching a copy of Form 1040-ES (if required), Form 2106-EZ (if needed), and the statement “Claim for Non‑Reimbursed Business Expenses for 2015”. If the tax code allows a deduction, how much does the tax cost me? If you do not have employee income, there is no tax deduction for any amount claimed under this paragraph. However, if you have business income, this deduction is reduced by your net operating loss. So in some ways, you are not actually entitled to the deduction because you cannot deduct the additional amounts paid by other taxpayers who are not your employees.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2106-EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2106-EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2106-EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2106-EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.