Award-winning PDF software

Irs 2106 instructions 2025 Form: What You Should Know

Instructions for Form 2106 (2021) | Internal Revenue Service Use Form 2106 if you were an Armed Forces reservist, qualified performing artist, fee-basis state or local government official, or employee with impairment- Note: Forms 2106 and 2111 are replaced by Form 2107. About Form 2106, Employee Business Expenses — Internal Revenue Service Information about Form 2106, Employee Business Expenses, including recent updates, related forms and instructions on how to file. Employees file this form f202117-01.pdf — IRS Go to for instructions and the latest information. Form 2107 (2021) | Internal Revenue Service Use Form 2107 (2021) to claim a deduction for certain expenses paid in connection with your work as an employee. If you were compensated with property or services for your use of a commercial motor vehicle as an employee, you must figure your deduction using IRS code (the section 706 standard). You must also figure your deduction using IRS code (section 1102). See instructions for Form 2107. Form 2107 (2021) | Internal Revenue Service Note: The form shows your employer's gross income. It does not show your actual compensation. You will need to find your actual compensation using Form W-2, Wage and Tax Statement, line 16 and line 14, and enter the number below that on line 14. If you had the opportunity to submit your Forms 11, 10-K, 10-Q, 2-99, 5-EZ, or 2-106 to your employer, and did not return to work without notifying your employer that you will be working part-time, you are entitled to the employee's credit for that non-waiver year. (Form W-2 must be included in calculations). Form 2107 (2021) | Internal Revenue Service 1040 – 2025 | IRS Forms 1040—IRS—Form 1040.pdf — IRS Use this PDF file to download a copy of Form W-2, Wage and Tax Statement, line 16 and line 14. If you do not have a W-2, you need to file a Form W-2–for some exceptions, see IRS Publication 549, Tax Guide for Small Business. If you use your own Form W-2, enter the total wages and tips shown on it.

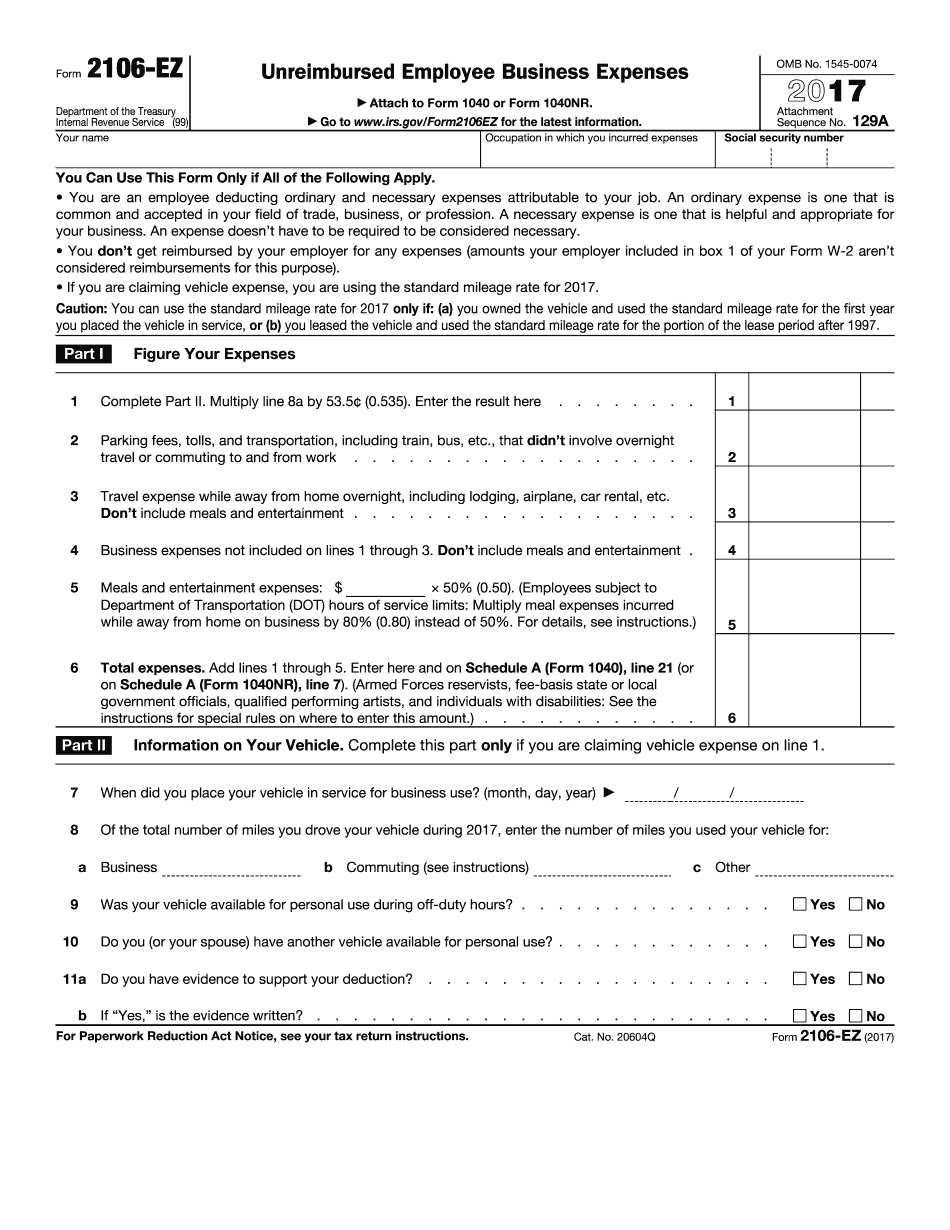

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2106-EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2106-EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2106-EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2106-EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.