Award-winning PDF software

2106 fillable Form: What You Should Know

If you have questions, write us. Please do not mail. Note: It is the taxpayer's responsibility to ensure that the Social Security Numbers on submitted tax returns are correct. If the tax filer's Social Security number is on file with the IRS, the Taxpayer should notify the Taxpayer's Employment Services office as soon as possible of any change. Taxpayers should be aware that there have been recent changes in the IRS' regulations that may affect the use of the Cole Form 2106. These changes have been made for two reasons: First, IRS employees have expressed concerns about potential identity theft which may result from use of the Cole Form 2106. Secondly, as a result of recent legislative changes to the Internal Revenue Code which affect the definition of professional and business activity for the purposes of tax law, the IRS may not collect from taxpayers with a Social Security Number or similar personal identification information used for employment tax purposes in the future. If you use a Cole Form 2106, the IRS has not endorsed the form. Any tax return that is prepared using the Cole Forms 2106 should be verified by the IRS or an official IRS representative to verify that the information provided is consistent with current IRS policies and procedures. The 2025 tax returns that we receive are for tax year 2025 and prior. For information on tax years 2025 to 2013, you can use the 2025 to 2025 Tax Returns (2018 Tax Returns). Use the Form 2105, Income Tax Return for Fiduciaries. 2025 Form 2105. Employer Business (Fiduciary) Election. (2018 Form 2105) If you are an employee, the Form 2105 must be used to report certain payments to your designated payee and to file a tax return. Use the Form 5305, Notice of IRS Individual Income Tax Return. 2025 Form 5305. Filing Form 5305. 2025 Form 5305, Employer Business (Fiduciary) Election. If you are an employee and you elect to treat your employer as your individual taxpayer, then you have the option of making payments as described in the IRS Publication 926, Payment of Compensation by an Employee to His or Her Alien Expatriate, which is available here: (purchase a copy from the IRS website at:).

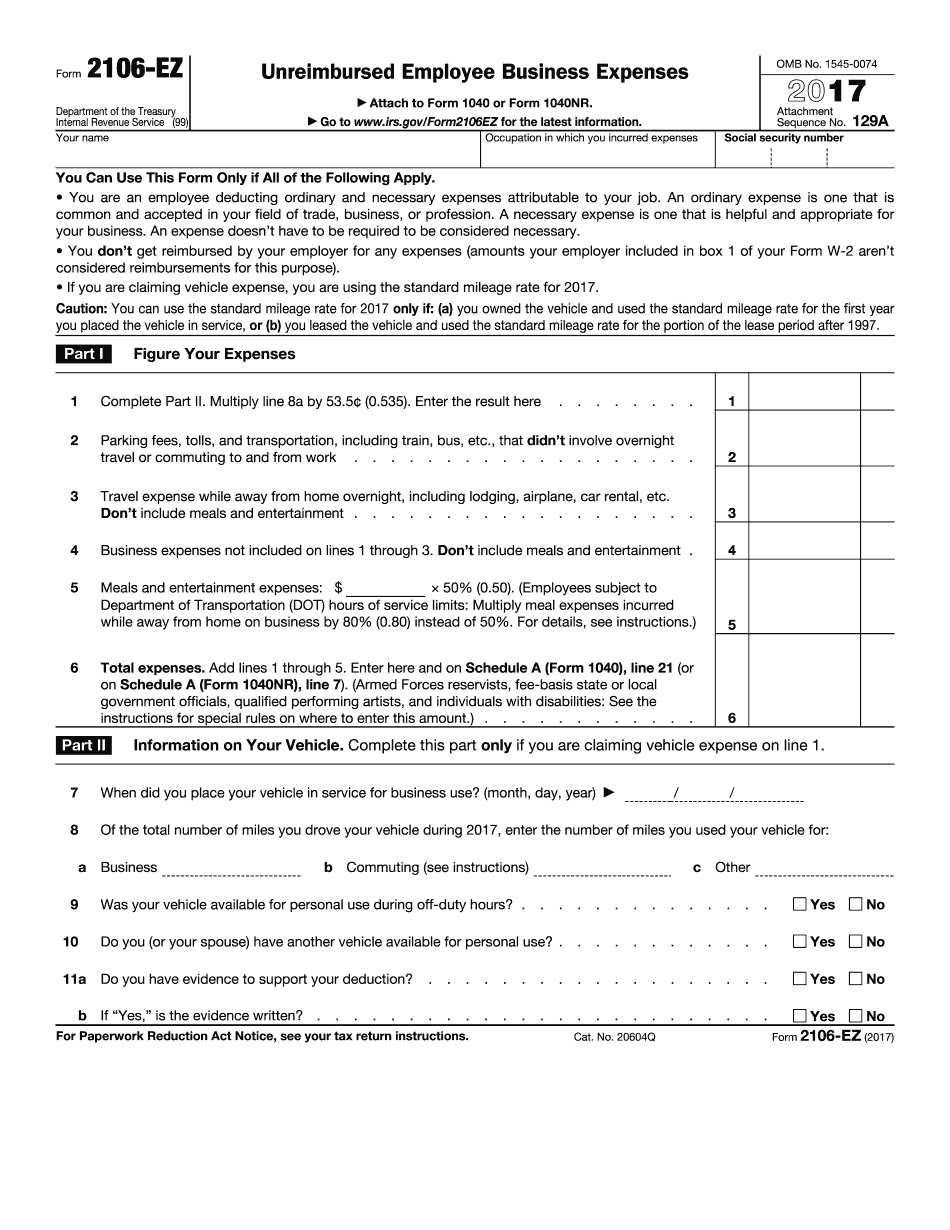

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2106-EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2106-EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2106-EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2106-EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.