Award-winning PDF software

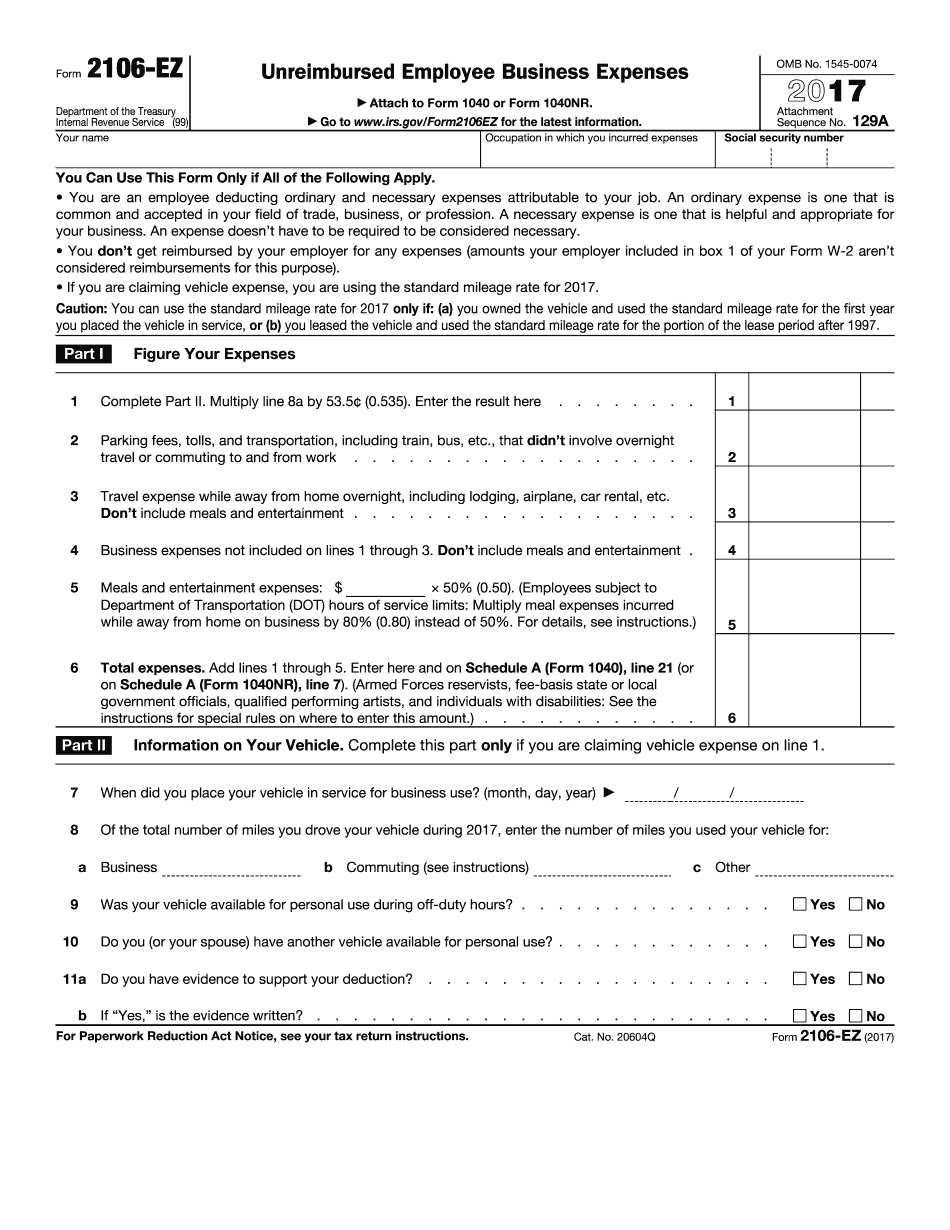

Albuquerque New Mexico online Form 2106-EZ: What You Should Know

Student loan interest deduction. Attach the form 4562 for the health savings account deduction. Taxpayers, you can mail or fax us Form 3903 — Health Savings Plan Deductions. You have the option to get signed off letter form at tax times before tax is due. Online Services For Individuals : Taxation and Revenue New Mexico Form 3903. Health Savings Plan Deductions. See How To Get Tax Help for information about getting these publications and forms. Publication 493 — Taxable Income for Tax Years Beginning After 2015. — Publication 906. Exemptions for Individuals and Corporations. — Form 4953. For Individuals. For Corporations. New Mexico tax return with a filing fee for individuals is due by April 15. Paper New Mexico Tax Return. Please allow 2 weeks for delivery. Mail your return by certified or registered mail, return receipt requested, with your filing fee and a check for postage to: New Mexico Income Tax P.O. Box 98250 Albuquerque NM 87227 Fees: New Mexico tax return for individuals is free when you complete the Form 3903, Health Savings Plan Deductions. Taxpayers without a qualifying income, who have received a 1099-MISC from an employer for the amount of their New Hampshire and New Mexico income tax, will also receive the following additional benefits as stated on the form 3903. In New Hampshire : Tax paid to New Hampshire on your New Mexico income tax return. In New Mexico : Tax exemption of 50% of your New Mexican income tax on the part not included in New Hampshire or the part paid to other states. A “1099-DIV” form will be mailed to the name of the taxpayer you designate on Form 3903. You don't have to take the first two payments as a credit, but there will not be a credit for any New Hampshire income tax that has not been paid. New Sales and Use Tax Exemption — New Mexico Individuals, not corporations, get a 4.00 cash rebate from the New Mexico Department of Taxation each January and all the months in December and April for the current year if they file Form 2501 or Form 3720. No need to call the Department of Taxation. Online Services For Individuals : Taxation and Revenue New Mexico Form 4250 — Taxpayer Identification Number. See How To Get Tax Help for information about getting this form. Form 4250 (2), Electronic Filing of State Income Tax Returns.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Albuquerque New Mexico online Form 2106-EZ, keep away from glitches and furnish it inside a timely method:

How to complete a Albuquerque New Mexico online Form 2106-EZ?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Albuquerque New Mexico online Form 2106-EZ aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Albuquerque New Mexico online Form 2106-EZ from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.