Award-winning PDF software

Aurora Colorado online Form 2106-EZ: What You Should Know

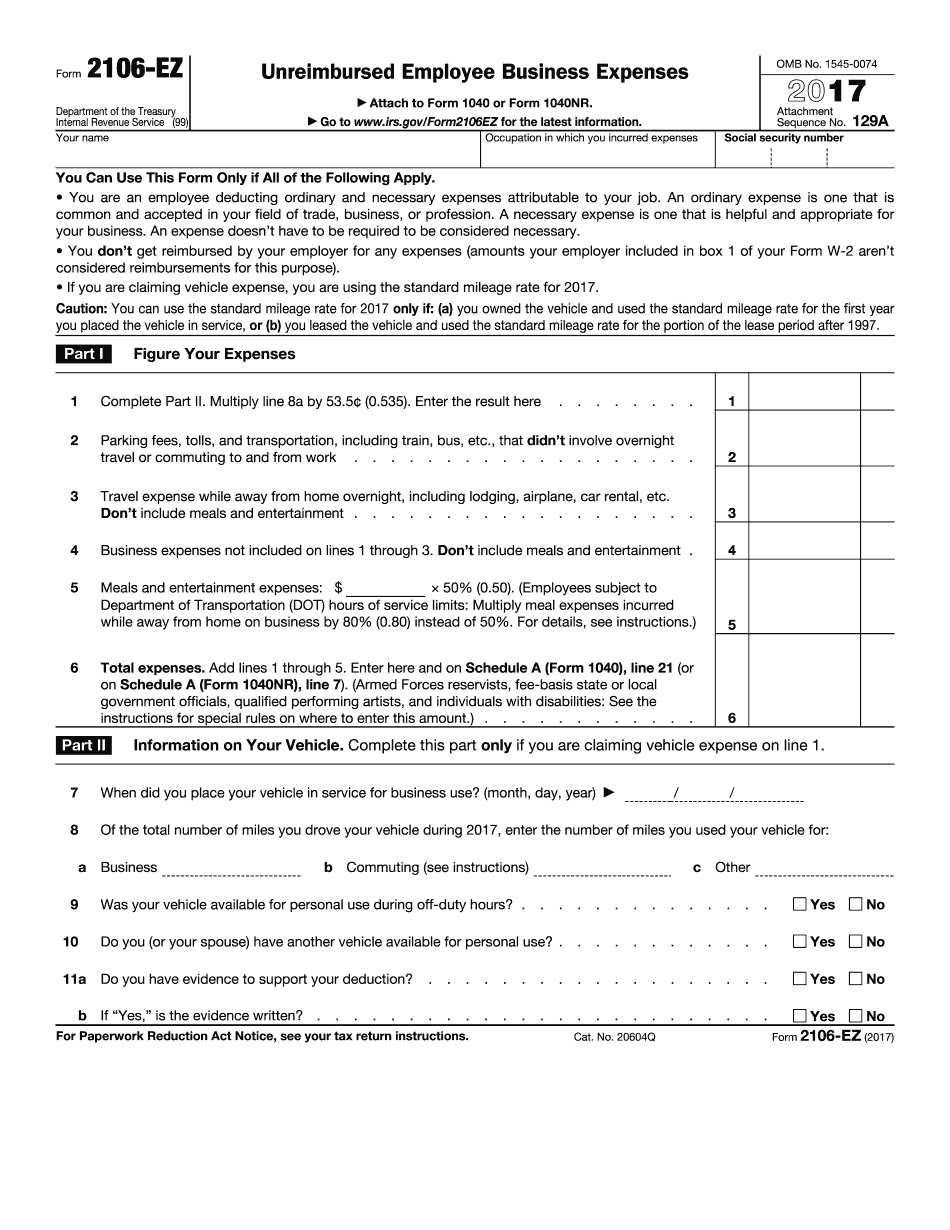

Both of the forms are for the same taxpayers and both of the forms are the same. If you have any questions regarding which are right for you, please feel free to contact the Tax Department and staff are available to answer questions via phone, or mail. You CANNOT claim this exemption if you have already filed your taxes using a different form. Form 2106-EZ is the only form that can be filed as a business expense. Your income tax form must be completed properly. The form must also be signed by your employer. For more information about the form, read the instructions carefully as follows. We urge you to only use the correct form and not to send incorrect forms that can result in penalties or garnishment of payment. The tax exemption code for 2025 is: 1040. This code covers all employees employed by the City of Aurora or employed on a contract basis on any city contract or public works project. There are also two state tax exemption codes that are also applicable to all Colorado residents, so if you are a Colorado resident, you are qualified for the exemption. The tax exemption codes are Colorado State Sales Tax Exemption (SST) and Colorado Sales Tax Exemption for Nonresidents (SS TNC). Please view the table below for definitions of these tax exemption codes and the rules that must be followed to claim the exemption. For Tax Year 2017 Taxed Status Taxed Form Exemptions You can Claim the Colorado Diversion Income Tax Refund If you have an income from income you received on a Colorado real property tax or real property development charge exemption, you may be eligible to claim a Michigan State income tax refund for 2017. For more information, please click here. This Colorado tax code covers property and personal income tax. Colorado's income tax is collected by the state and collected taxes are collected on the amount of gross income from all Colorado residents each and every tax return. The tax code is separate from other income tax. The Colorado state income tax code may give different income tax amounts based on tax rates than any other state. For information on tax rates in Colorado, please click here. Citizens of the City of Aurora, this exemption will apply if your actual, necessary expenses were to the extent of one, and a certain percentage of, your regular operating income, and you were a resident of the City of Denver for income tax purposes or a resident of the county.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Aurora Colorado online Form 2106-EZ, keep away from glitches and furnish it inside a timely method:

How to complete a Aurora Colorado online Form 2106-EZ?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Aurora Colorado online Form 2106-EZ aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Aurora Colorado online Form 2106-EZ from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.