Award-winning PDF software

Form 2106-EZ for Austin Texas: What You Should Know

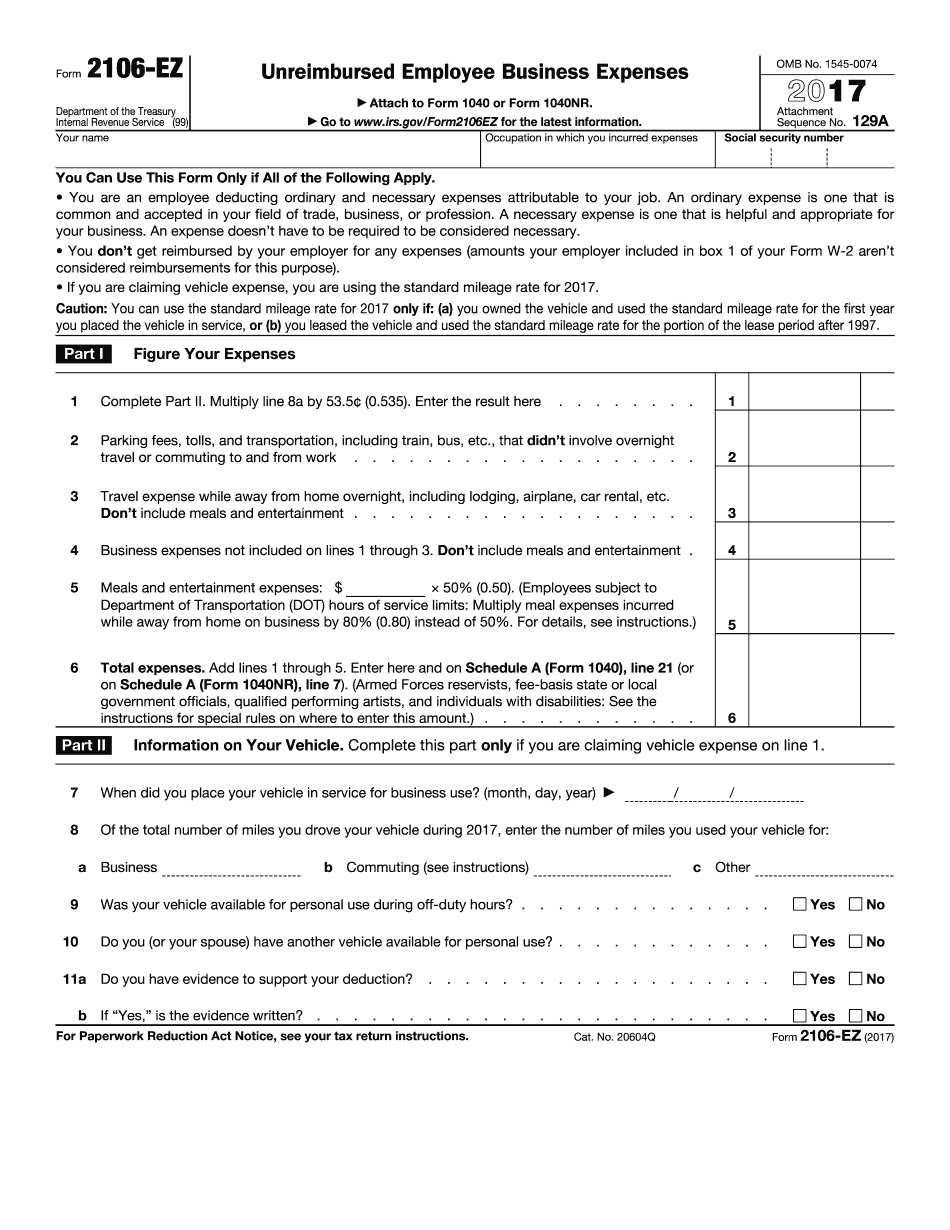

Attach Form 959. Deductible part of health insurance premiums. Attach Form 1099-MISC. Deductible taxes for contributions to an IRA. Attach Form 1099-PATR. Attach Form W-2. Income and expenses from noncash compensation. Attach Form 1099-K. If you were paid to attend a conference, book, exhibit, or workshop that a qualified organization was sponsoring, attach one copy of the conference brochure, one copy of the program flyer, and copies of all exhibits and materials given. See Publication 1774 at IRS.gov/Pub1774. For more information on Form 1099-K, visit IRS.gov/Form1099. For more information on Form 1099-PATR, visit IRS.gov/Form1099patr. Attach Form 5498 to the list of tax avoidance strategies to avoid double taxation. If you use your savings account or an IRA to purchase something for yourself, your deduction may reduce your tax bill if the government takes the deduction. Tax Guide 2016: Chapter 9, Section D, Page 101 This form was used by employees to deduct business-related expenses, including food, lodging, transportation, and meals. Form 2106, Reimbursed Employee Business Expenses If you are a reimbursed employee, the following items are allowable: • Food and lodging provided to you when on business. • Transportation expenses associated with business travel. • Food and lodging provided for your family. You can use this form only if all the following apply: • You are an employee deducting ordinary and necessary expenses attributable to your job. • You have signed the approved form. • Once the form is completed, push Done. For more information, or to download Form 2106-EZ, visit IRS.gov/Form2106. Filing Form 941 With the CRA is using a new website system to help taxpayers and taxpayers with their tax preparation and reporting. To help you make the most of your website use, we have published several tips to help make the most of your filing time. These tips are also available on the Taxpayer Advocate Service's website, How to file an electronic tax return on the CRA's new site: Before the end of 2016, the CRA will launch a new website for online tax filing and is seeking qualified users to provide feedback on the application.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2106-EZ for Austin Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2106-EZ for Austin Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2106-EZ for Austin Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2106-EZ for Austin Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.