Award-winning PDF software

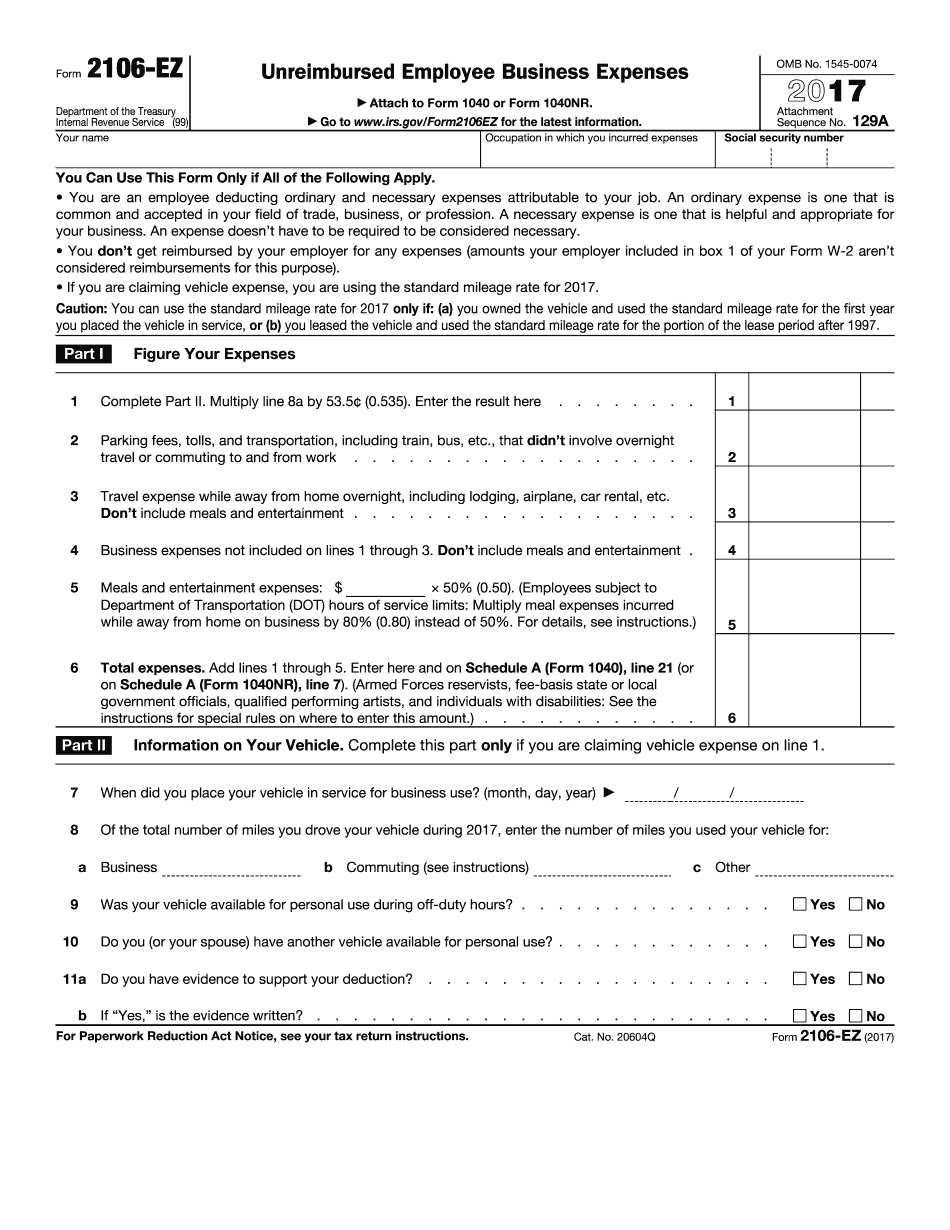

Form 2106-EZ for Tallahassee Florida: What You Should Know

If over age 65. Your tax situation may not have changed. If you don't want to make a change, submit your 2025 tax return. To send your 2025 return to the IRS, you must use Form 1040EZ, which is free with your 2025 tax return. Use our FREE File and Submit Form 1040 with Free PDF Format Guide. You Can Use This Form at Any Time to Claim Certain Deductions and Credits. • Do not use this form to claim tax credits and deductions for the following types of expenses. Eating Out (a deduction) • Dining out with family or friends for less than the normal cost. • Special meal. • Dining in an establishment which is less than 35% of your federal adjusted gross income. (2) ✓ if under 18. (2) ✓ if under 26. The following costs are deductible under section 165(h) for certain public servants only if they must: • Work for a particular employer for more than 12 days. • Use public funds for their personal expenses. • Work within the scope of their official duties. (1) ✓ if under 24 years old. (1) ✓ if under 16. A tax deduction may not be claimed for certain property, such as vehicles. To claim an expense in section 165(e)(1) you must be the original owner or a member of the original lineal ancestor of the taxpayer who acquired the property, including a partner and an individual who has the same beneficial ownership. If you are a partner, you must also be a member of your partner's lineal ancestor. Example: An employee is reimbursed for 8,000 of the cost of her personal automobile by her employer during the tax year. However, the IRS claims an allowable deduction for this expense, as the costs are associated with her job and the employee is not reimbursed for the expenses incurred at the property. However, it is possible that the original taxpayer could claim an allowable deduction for the expenses. If the original taxpayer's interest, rental, or leasehold interest in the property is considered to be the same as the cost of the personal automobile, and the original taxpayer is also entitled to a tax deduction for the automobile, then the original taxpayer may be entitled to claim an allowable deduction for the automobile. Here's an example.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2106-EZ for Tallahassee Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2106-EZ for Tallahassee Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2106-EZ for Tallahassee Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2106-EZ for Tallahassee Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.