Award-winning PDF software

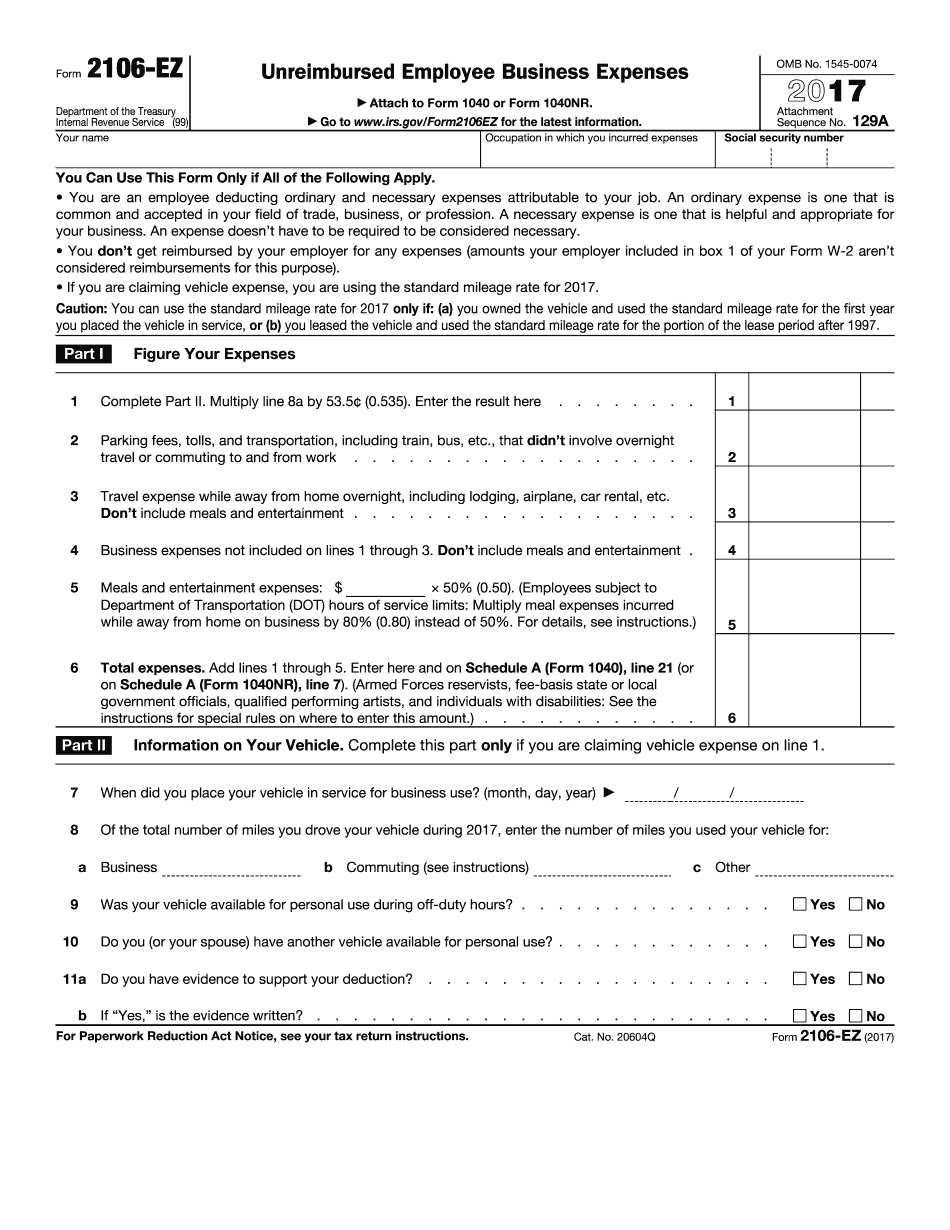

Form 2106-EZ Irving Texas: What You Should Know

Mar 4, 2025 — Form 2106 is only available in most cities in the United States. Form 2106-EZ-TIP.pdf — IRS Form 2106-EZ was used by employees to deduct expenses related to their job. This form was discontinued after 2018 See IRS Form 6166, The IRS has two different types of Forms 2106 that you can use to claim non-reimbursed expense you incur during your normal course of work. For IRS Form 2106-EZ-TIP.pdf, modify the PDF form template to get a document required in your city. Then send it to the IRS! Forms 5471 and 8331.pdf — TurboT ax Tax Tips & Videos Dec 22, 2025 — The IRS replaced the Forms 5471 and 8331 in 2017. It Does not have the following features. This may not be a problem for you. Do You Have a Problem with Two Different IRS Forms? In January 2018, TurboT ax reported that there were five times more Forms 2106-EZ sent to TurboT ax then there were in 2015. It's likely that the IRS was more aggressive in its outreach to taxpayers in 2025 due to the implementation of the American Taxpayer Relief Act (AURA) of 2012. Will these Changes Cause Taxpayers to Stop Sending Back Form 2106-EZ This is a Good Thing. If you are not a Reimbursed Employee, use this form to Deduct the following types of expenses, which must be deducted if they are not allowed by the IRS: Travel, meals, and lodging. This is for the employee on business travel, not just on personal time. Vehicle expenses, if they are included on your income tax return. Housing and utilities. If not deductible from your income tax return, and you paid more than the value of your mortgage. (These are considered non-relief expenses). If, like many taxpayers, you are using a tax-preferred account, the interest on a portion of your mortgage would be deductible at a rate of 2.35 percent (5/31/14), and it could be higher if you are using an HSA. You will want to have receipts for these expenses to be able to claim them.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2106-EZ Irving Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2106-EZ Irving Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2106-EZ Irving Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2106-EZ Irving Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.