Award-winning PDF software

Form 2106-EZ online Baton Rouge Louisiana: What You Should Know

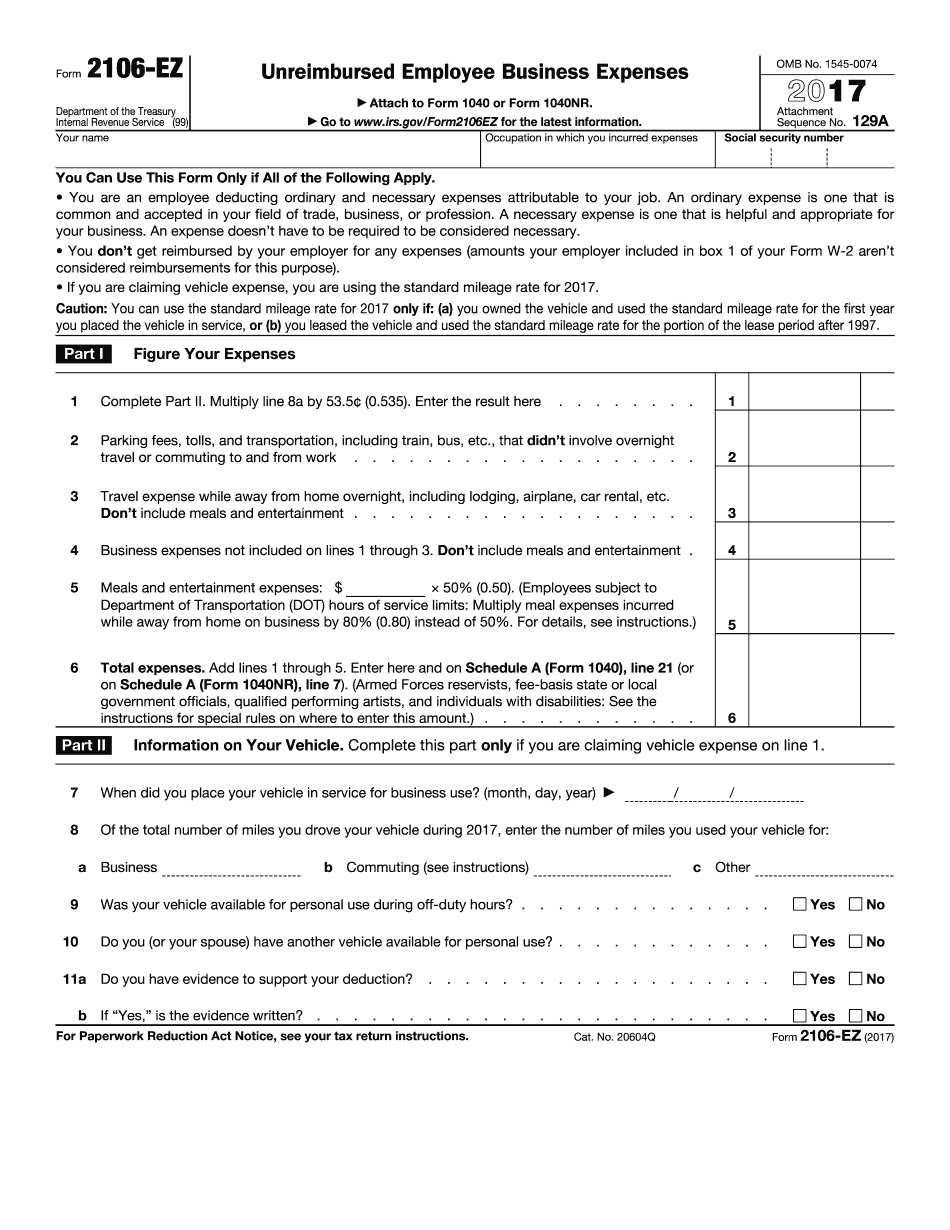

Expenses. Amounts for your business expenses may be deducted on line 13 of your tax return if those expenses are properly itemized. To determine if your home is a business, use Form 2106-EZ. See the instructions on that form. If you have to deduct expenses for hiring or making equipment and for doing work that was not normally performed by the business, a separate line applies. These items can't be treated as ordinary and necessary expenses. See the instructions for Form 2106-EZ on the IRS website. The rules for employees to take deductions on their return depend on whether the person being taxed is your spouse. Deductions: To take a deduction for a business expense, your spouse had to pay income tax on the business interest at the end of each tax year. If you are married and your job is a partnership, you may not claim a deduction for your business expenses. However, the amount deducted for your job may be considered a personal deduction for the partnership. See this question and answer for more information on this topic. If you are married, and you are subject to income tax by both Arkansas and Louisiana, you must take into consideration any state tax that you may have to withhold. The deduction limits that apply to either state will also impact the amount of any state tax that may be withheld. If the amount you deduct for your business is more than the limit set forth in a limitation period for an itemized deduction or for a credit against a tax, you may have to pay the difference. Form 1098-MISC, Miscellaneous Income — IRS If you make your income tax return using Form 1098-MISC, your expenses for doing business in the past year, you may use the following information about any nonbusiness expenses of your business as your basis. To use Form 1098-MISC, you must be either a sole proprietor, a partnership, or a corporation that is a member of a controlled group but has more than 5 members. Note: Forms 1098-MISC are not available to self-employed taxpayers. To use Form 1098-MISC, you must report your business taxes and any other income, deductions, credits, or expenses that apply to you. Other than any income you earned at your business and other losses you may have sustained by your business, your basis is the amount you have actually reported and your basis in property held at your business.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2106-EZ online Baton Rouge Louisiana, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2106-EZ online Baton Rouge Louisiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2106-EZ online Baton Rouge Louisiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2106-EZ online Baton Rouge Louisiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.