Award-winning PDF software

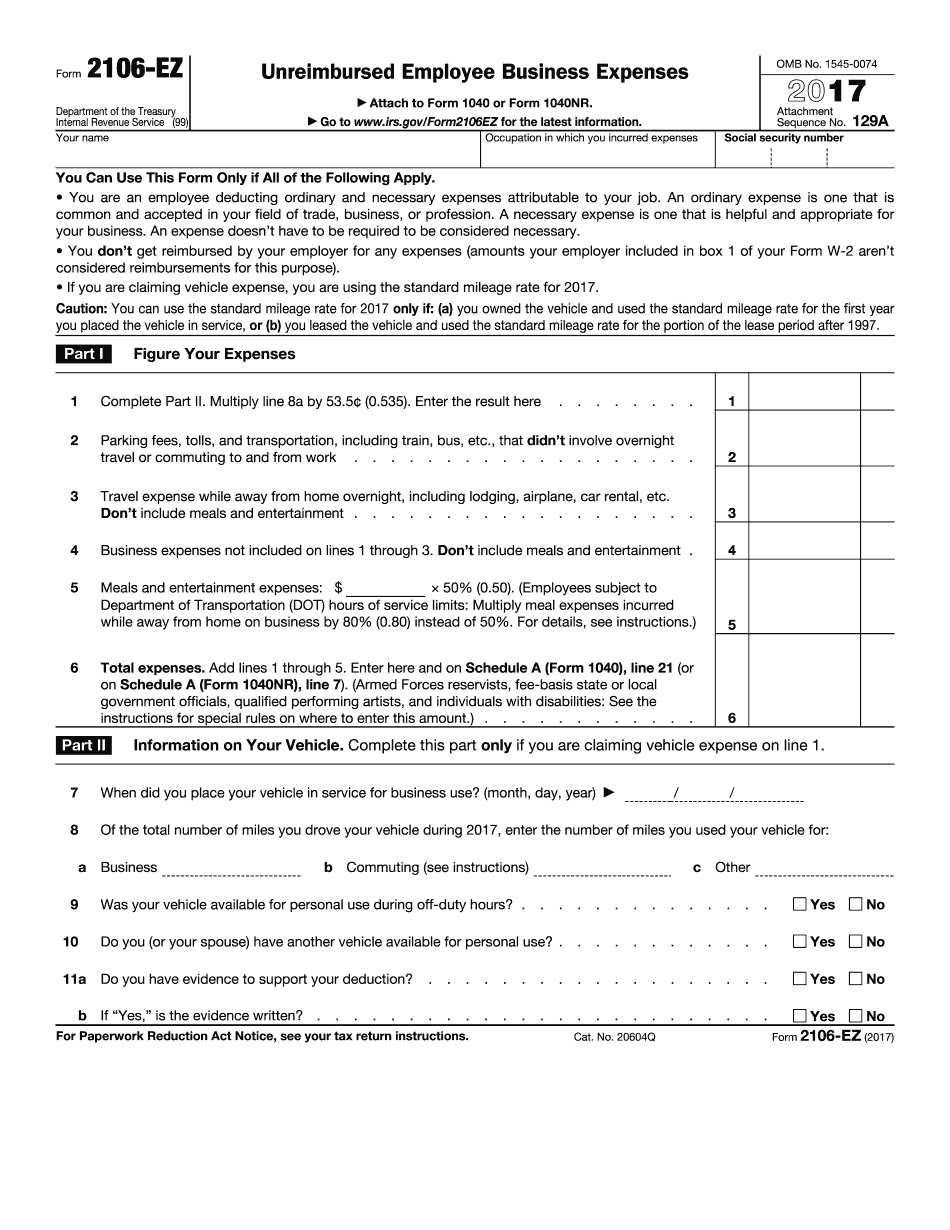

Form 2106-EZ online Palm Bay Florida: What You Should Know

Bacon cheeseburger 13.99 + tax. Bacon cheeseburger 13.99 + tax. Beef 'O' Brady's, 703 Fowl Creek Park Road, Palm Bay, Florida 33313 Click here to order online from Beef'O'Brady's in Palm Bay. Click here to view beef 'O' Brady's menu. Call us now to place your order. Frequently Asked Questions About the 200 Tax Credit for Restaurants 1. Can my customers use the restaurant tax credit? Yes. You can apply the credit for expenses you have incurred for food to your customers in the same way as if they were personal expenses. 2. Which expenses must I claim under the restaurant tax credit? You must claim the following expenses: • Food and beverages. Food and beverages are an expense. You are reimbursed for the costs of food and beverages from your general income tax liability for the period in which you spend more than 4,000 in a calendar year at your restaurant. You must report the entire amount of the credit on line 26 of your 2025 Form 1040. • Locker rentals, linens, paper products, and related supplies. For each day you rent a locker or store linens, or buy or use paper products to the extent you are buying or using paper products, you report the amount in Line 2 of your 2025 Form 1040. You must subtract the amount you report in Line 2 from the total amount of the credit on your Form 1040. • Rent or lease of a vehicle. You must report the amount of the credit in Line 13 of your 2025 Form 1040. • Parking fees. You must report the amount of the credit on Line 24 of your 2025 Form 1040 (the amounts shown on the front and back forms of Form 2106-EZ). The amount shown on the front form does not count as part of your total parking fees. 3. Do I have to report any additional nonrecurring expenses from my restaurant? Yes. You must also report any reimbursed business expenses from your restaurant's business activity in the same way as if you had claimed the expenses on line 26 of your 2025 Form 1040. For example, you must report any rent or lease fees and other nonrecurring expenses that you have incurred before you begin to claim the 200 restaurant tax credit.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2106-EZ online Palm Bay Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2106-EZ online Palm Bay Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2106-EZ online Palm Bay Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2106-EZ online Palm Bay Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.