Award-winning PDF software

Form 2106-EZ online Plano Texas: What You Should Know

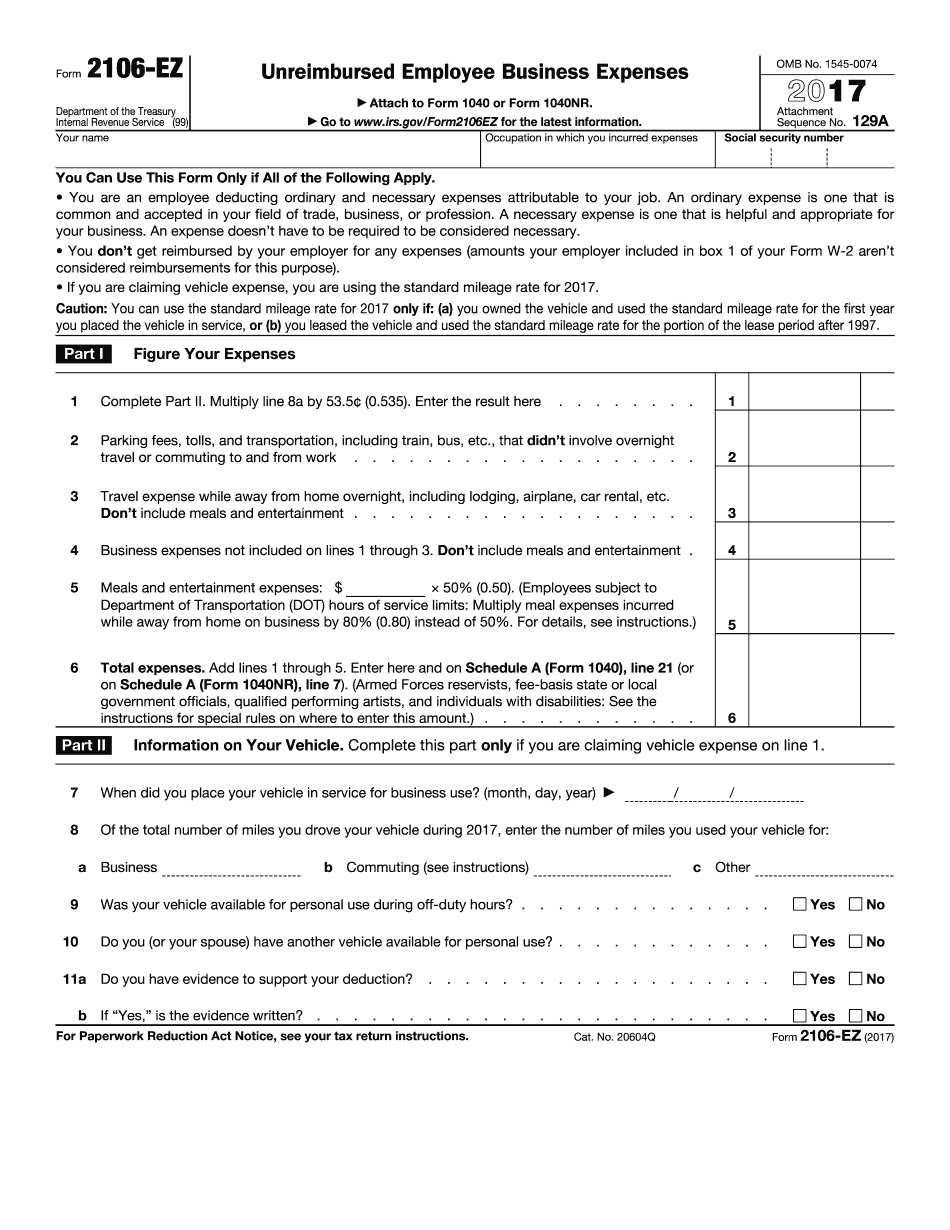

Filed by: City of Plano. Filed in: DATE TYPE: DATED 1/8/2014 PLACE OF OCCURRENCE : PLANO, TX, 75 DATE TRANSFER TO: PLANO, TX, 77 Income Tax Returns Form 1040-EZ Form 1040-EZ was used by employers to report the net business income of their employees. It was discontinued after 2018 For Form 1040-EZ Online Plano Texas, Fill Exactly (PDF) the Template to Get the Report Form 1040-EZ: Reimbursed Employee Business Expenses There are 4 items that will cause the amount of compensation the employee will receive to be taxed as income. These expenses are: Insurance Lodging and Travel Entertainment and Food There is no tax rate associated with each of these expenses. You must calculate your taxable income on Schedule C of Form 1120-X (Form 1040a). Taxable income earned by your employees • Insurance costs include the cost of any non-wage health insurance premiums and the cost of dental coverage. • Lodging and Travel The percentage of gross income earned by your employees can vary from 50% to 100%. This can affect your amount of employee compensation you can tax as income and the amount that may be withheld from your employees' pay. Your plan must provide for the payment of a minimum amount for lodging, which does NOT include room only rental costs and transportation costs for working from home. • Entertainment and Food If any part of your employee's compensation consists of these items, you will calculate this amount as either a fixed dollar amount per employee or as an aggregate percentage of adjusted taxable income. If you choose to treat these expenses as allowable deductible expenses, you will either report the entire amount deducted as wages or as gross income. You will not have to figure out the percentage of compensation earned that may be taken as wages. However, you may be able to deduct all or part of the expense as a business expense deduction. For more information, refer to the “Entertainment and Food” sections in Publication 535, Employers' Supplemental Tax Guide. If your employer allows deduction of wages as an employee expense deduction, the amount deducted must cover at least as much of the cost of your employee's living expenses as you would have deducted for the same expenses paid for them as a business expense.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2106-EZ online Plano Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2106-EZ online Plano Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2106-EZ online Plano Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2106-EZ online Plano Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.