Award-winning PDF software

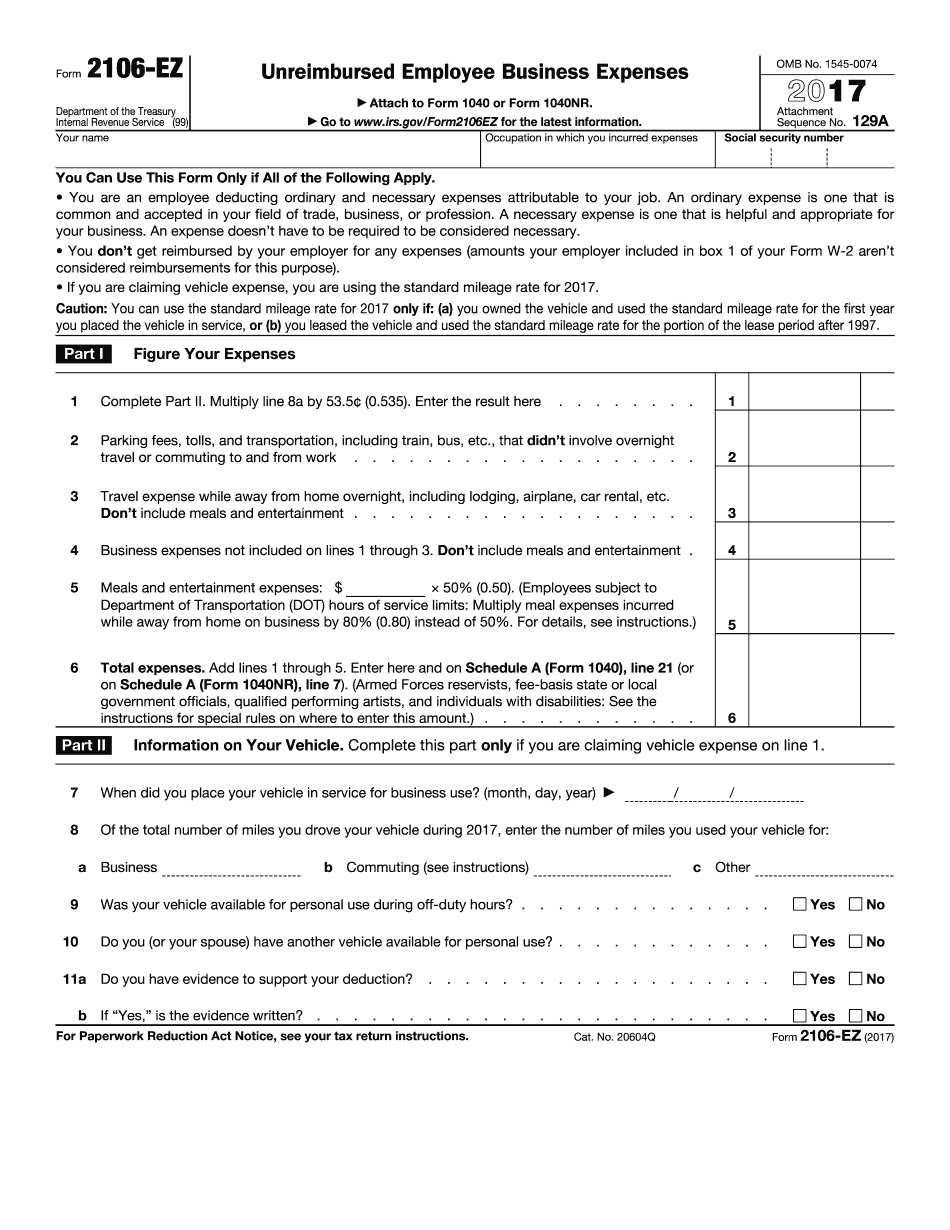

McKinney Texas Form 2106-EZ: What You Should Know

For more information about the Tax Organizer check the Tax Organizer page at the Texas State Law Library website. Employee Handbook — San Marcos — Employment taxes and employee handbooks for companies with one location or more than ten employees. Employee Handbook — Waco — Employment taxes and employee handbooks for companies with more than ten employees. Exchange of Payments Guide. This guide was made available through the Texas Department of Revenue on January 5, 2017. The guide provides an overview of the requirements in regard to exchanging payments between public agencies. For more information about this guide and other Texas tax documents visit the Texas Tax Code section at this website. If you receive an employee statement, pay stubs, or other paper document which contains the required information, you must provide a copy to an employee (or you can send your copy directly to the IRS). If a copy is not provided to an employee, the employee will file the statement instead of paying your tax bill. There is an additional 500 tax penalties imposed (unless the employee has filed the required notice using Form 2106-X — Employee Business Expenses). If you are considering the use of Form 2106-EZ as your sole source for expenses for the employee's work, you should be aware of the following: • The penalty for failure to provide any required information increases from a 50 100 penalties to a 300 500 penalties if any of the information in the notice is wrong or incomplete. • The penalty for a frivolous or misrepresentation increase from a 50 100 penalties to a 300 500 penalties if any of the information in the notice is inaccurate or does not properly conform to the requirements of the form. • If you are using the form to claim business-related expenses or expenses for which you do not have to file a separate Schedule C, you must complete the entire form. If the employee did not receive a Form 2106-EZ, you should complete the following. Exchange of Payments, for Non-Reimbursed Employee Expenses. The tax must: • Be in the same format, print and fillable, and include the correct tax tables and columns. (For the Form 2106A, Form 4867, Form 940EZ, or Form 2106-EZ, you must also complete the correct portion of the exchange of payments instructions.) • Be in the form of a letter.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete McKinney Texas Form 2106-EZ, keep away from glitches and furnish it inside a timely method:

How to complete a McKinney Texas Form 2106-EZ?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your McKinney Texas Form 2106-EZ aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your McKinney Texas Form 2106-EZ from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.