Award-winning PDF software

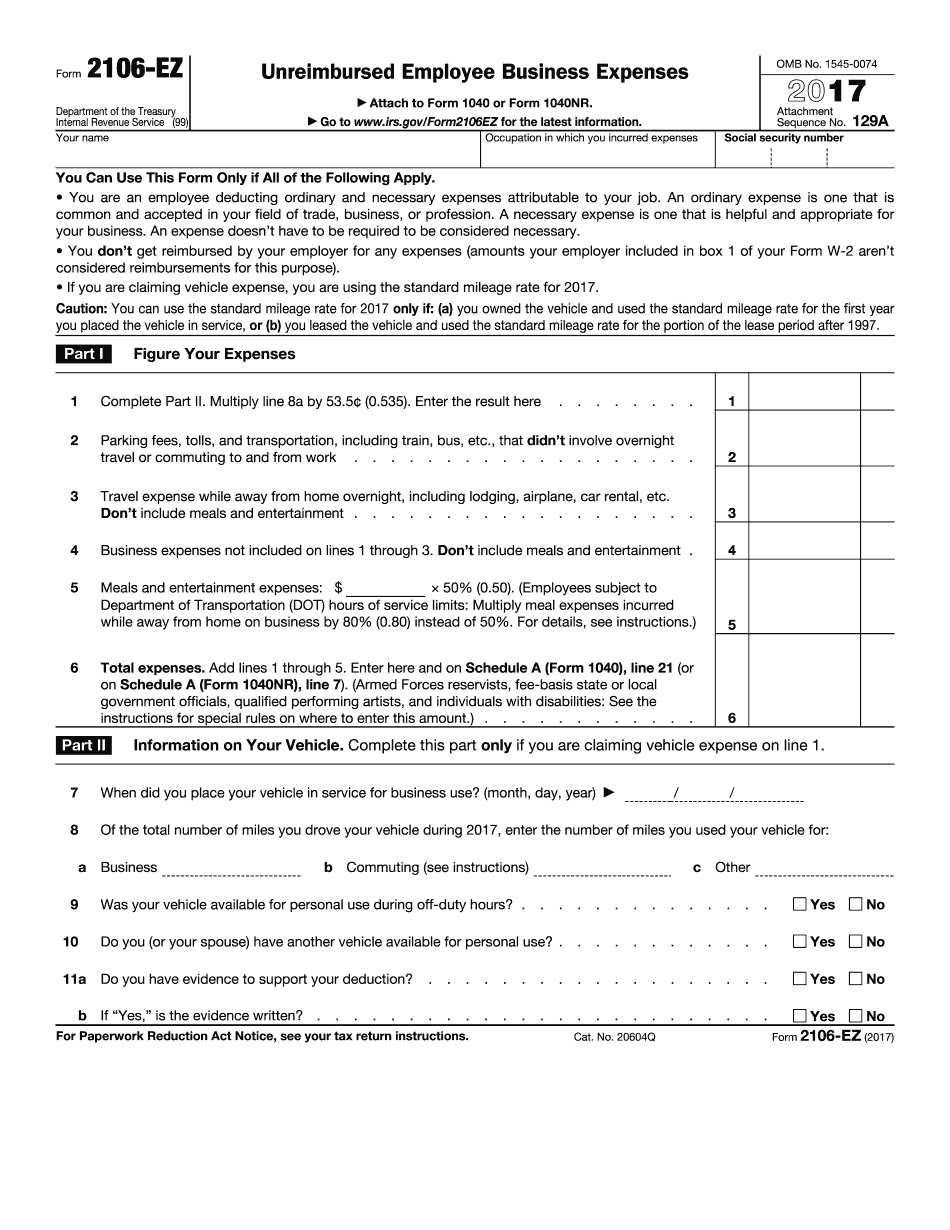

Mesa Arizona Form 2106-EZ: What You Should Know

The cost of living is 742.08 per month. She and her husband each earn 10,000 while also taking care of two teenage children, ages 5 and 10. Her gross annual income including social security is approximately 70,000, but for tax purposes the couple can be considered as married for tax purposes. R. Jordan and her husband do not file a joint tax return but instead file their taxes in order of filing status, which means they file their taxes together and separate their social security numbers. The R. Jordan's tax return shows that they have a total income of 70,000. They owe 40,000 in income taxes and another 20,000 in sales taxes. The cost of living is 742.08 per month. The R. Jordan's total income includes Social Security and Medicare benefits earned from a previous job where she worked in an office. She is not working for hire at the moment and earning her own income, which was about 30,000 a year at the time they separated. R Jordan was the last person listed in their household in the income tax return. R Jordan and her two children attend a local Christian Academy, with a cost of living of 904 per month. The average cost of living in her household is almost 40,000. The R Jordan's total income includes wages from her previous job and Social Security and Medicare benefits. Social Security alone is more than 40% of the total income. The average cost of living in her household is nearly 40,000. The R. Jordan's total income includes wages from her previous job and Social Security and Medicare benefits. Social Security alone is nearly double the amount of income that comes from Social Security and Medicare. The average cost of living in her household is almost 50,000. The cost of living in R. Jordan's household is 71.84 per month. R Jordan's cost of living is 742.08 per month. R Jordan is an active member of her church with a combined gross income of 43,000. The cost of living is 705.22 per month for the R. Jordan household. The R. Jordan's total income from church is approximately 35,000. The total Social Security benefit is 20,000. The cost of living, Social Security, and church costs for the R. Jordan household total 75,000.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Mesa Arizona Form 2106-EZ, keep away from glitches and furnish it inside a timely method:

How to complete a Mesa Arizona Form 2106-EZ?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Mesa Arizona Form 2106-EZ aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Mesa Arizona Form 2106-EZ from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.