Award-winning PDF software

Chicago Illinois Form 2106-EZ: What You Should Know

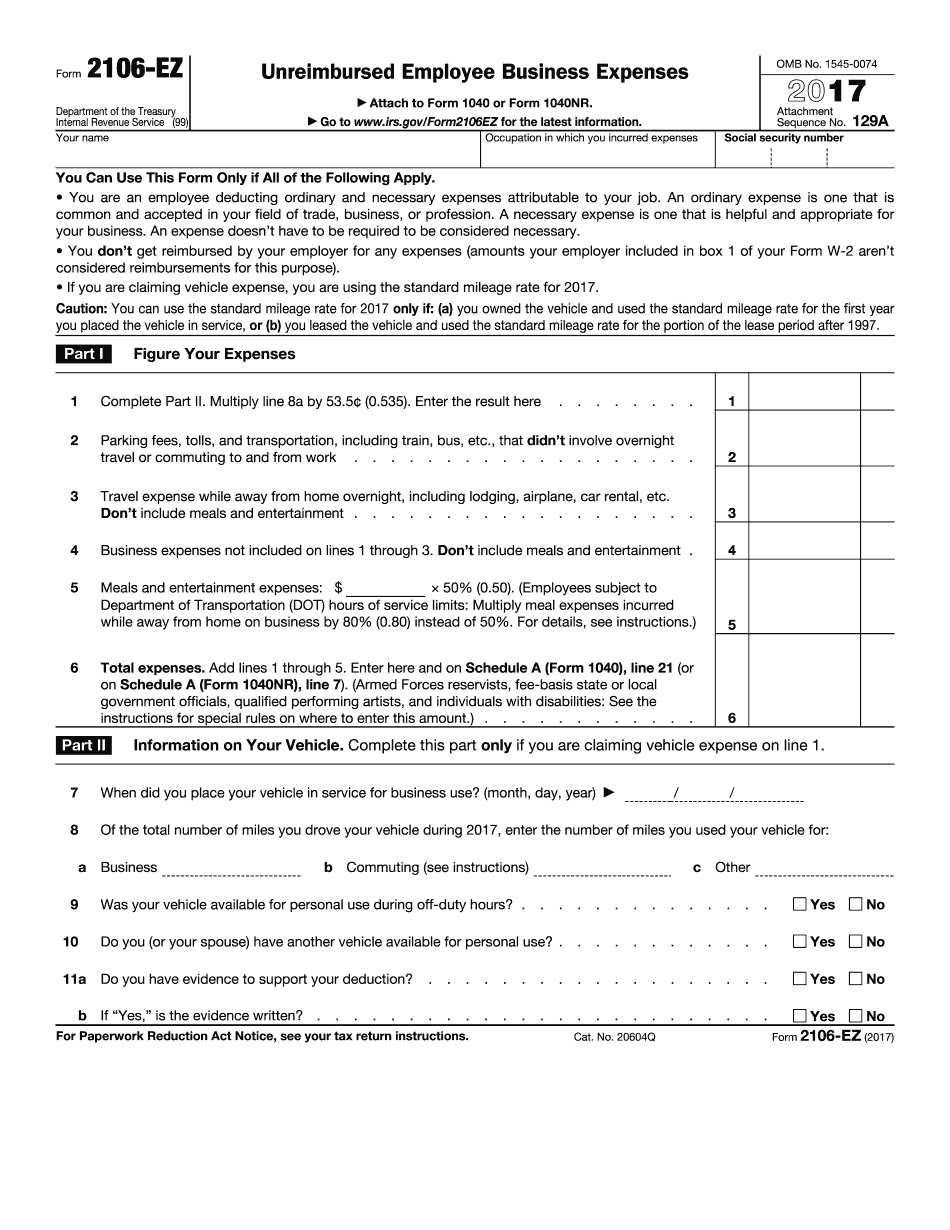

Expenses include travel to attend meetings and conferences; meals, beverages, and lodging you paid or reimbursed; other employee-related expenses not directly related to your work; the cost of your equipment (such as laptops and business travel) and the rental or sale of similar equipment; and office supplies, computers, software, and books that are for your own use. Example: An accountant has a 250,000 salary and expenses of 20,000 for conferences. These include 10,000 for travel to attend conference meetings, 3,000 for meals, and 7,000 for personal use items such as stationery and stationery supplies (including stationery used to prepare your income tax returns). Non-Employee Business Expenses: Advertising You may also use Form 2106 or Form 2106–EZ for non-reimbursed expenses you incur to advertise your business. For example: An accounting firm makes 100,000 and invests 50,000. A full-page ad on a local newspaper calls attention to the firm's services. You can report the expenses as a deduction on your income tax return, and you may deduct them even if you are not the advertiser, such as if you: A person creates a video and you as the person in the video endorse the video. An employer sponsors educational videos at the request of an employee. Example: You own the business for which you advertise. You can only deduct expenses to advertise your business unless you are the endorser (i.e., you endorse the video). Note that you do not need to keep records of these expenses. Form 2106-EZ: Reimbursed Employee Business Expenses For employees who meet certain requirements, you may use Form 2106-EZ instead of Form 2106. For more information on Form 2106-EZ, go to Form 2106. For more information, go to IRS.gov/payments/employee-business-expenses-tax-deduction Mar 4, 2025 — The IRS has two different types of Form 2106 that you can use to claim non-reimbursed expenses you incur during your normal course of work. Employee Business Expenses: Investments Generally, you must use Form 2106 or Form 2106–EZ to figure your deduction for employee business expenses and attach it to your Form 1040 (PDF).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Chicago Illinois Form 2106-EZ, keep away from glitches and furnish it inside a timely method:

How to complete a Chicago Illinois Form 2106-EZ?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Chicago Illinois Form 2106-EZ aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Chicago Illinois Form 2106-EZ from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.