Award-winning PDF software

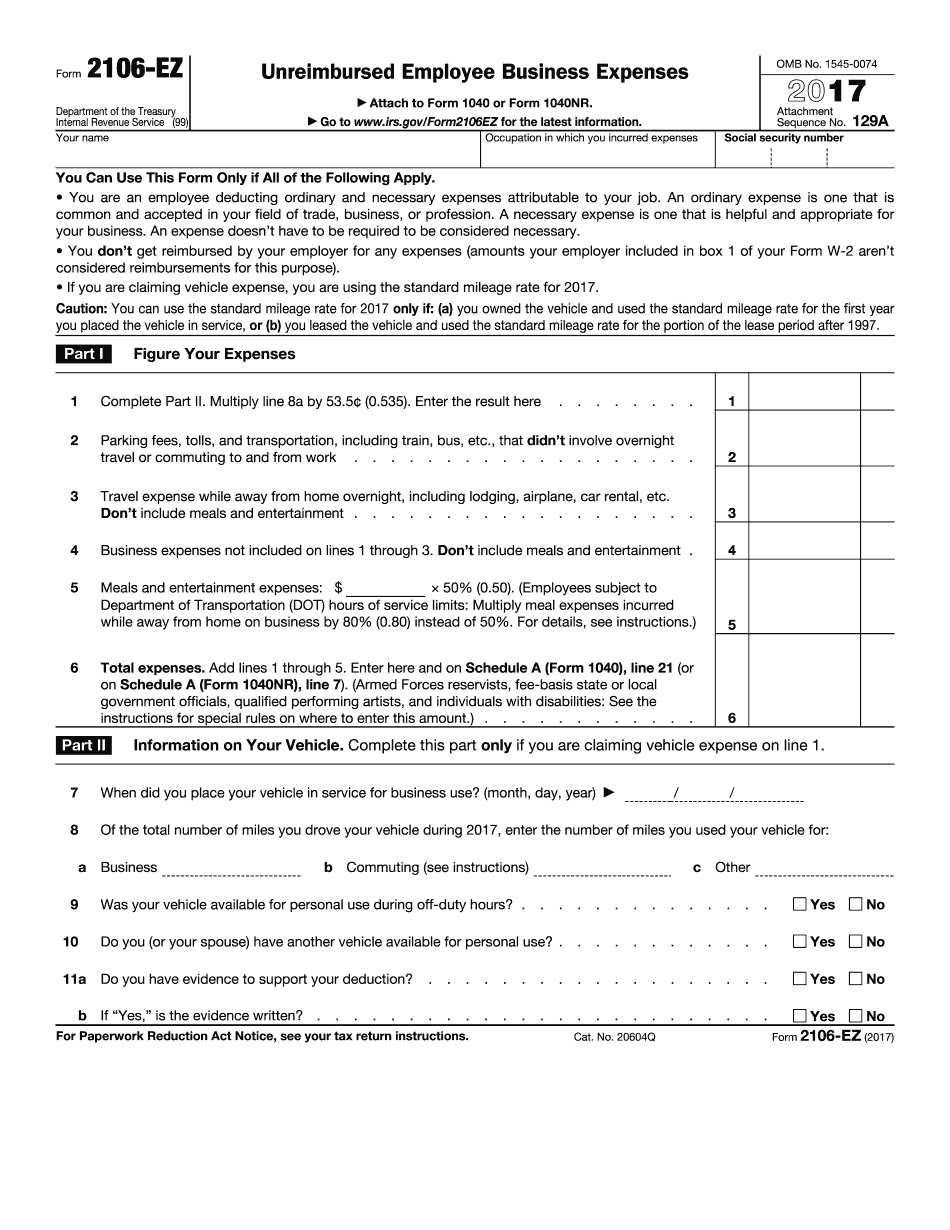

Form 2106-EZ Sterling Heights Michigan: What You Should Know

Sterling Heights Michigan. The instructions and any materials that accompany this form are to be made available to the taxpayer, on request by the taxpayer, within 30 days of the date of the mailing of this form. Sterling Heights Ohio for Form 2106. Michigan is asking taxpayers to fill out Form 2106-EZ to determine how they could be reimbursed for a business or business related expense that they incurred on or after June 6, 2012. How do I make this form for Sterling Heights I had to go through the form and make sure it was filled out exactly for Sterling Heights — I had to make sure it was the proper spelling and capitalization of the forms. I filled out every word of every sheet and then went to go to get my letter from the form. I got my letter today and was surprised because it stated that my tax form was sent! I have received my form in the mail and so can't tell whether it's a joke or I might actually be getting an actual letter on the topic. Is there a difference between your City and state taxes? How do I change one form to another City or State Tax form? The form is in PDF format. The PDF that you fill out, does actually tell you exactly what it says. If you want to change form from Vlahantones or Abalones, P.C. to another company, just go online and pay the difference for the tax period that you want to change it in — it's really that easy, and you don't even have to do all the math. Here is how you can pay the additional tax on your taxes. You have to pay in two steps — the first is to pay the state tax now. Next make sure you get the correct form 2106-EZ that you have to get on your return and pay your tax form now. Sterling Heights has changed the form 2106-EZ for my state tax, so what should I do now? The IRS now recommends the filing of Form 1042-S as your sole return by March 31, 2015. The IRS has not released a final rule for Form 1042-S with information on the tax treatment of the Form 1042-S. The Form 1042-S also uses a different name: Form 1042-S, U.S. Individual Income Tax Return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2106-EZ Sterling Heights Michigan, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2106-EZ Sterling Heights Michigan?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2106-EZ Sterling Heights Michigan aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2106-EZ Sterling Heights Michigan from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.