Award-winning PDF software

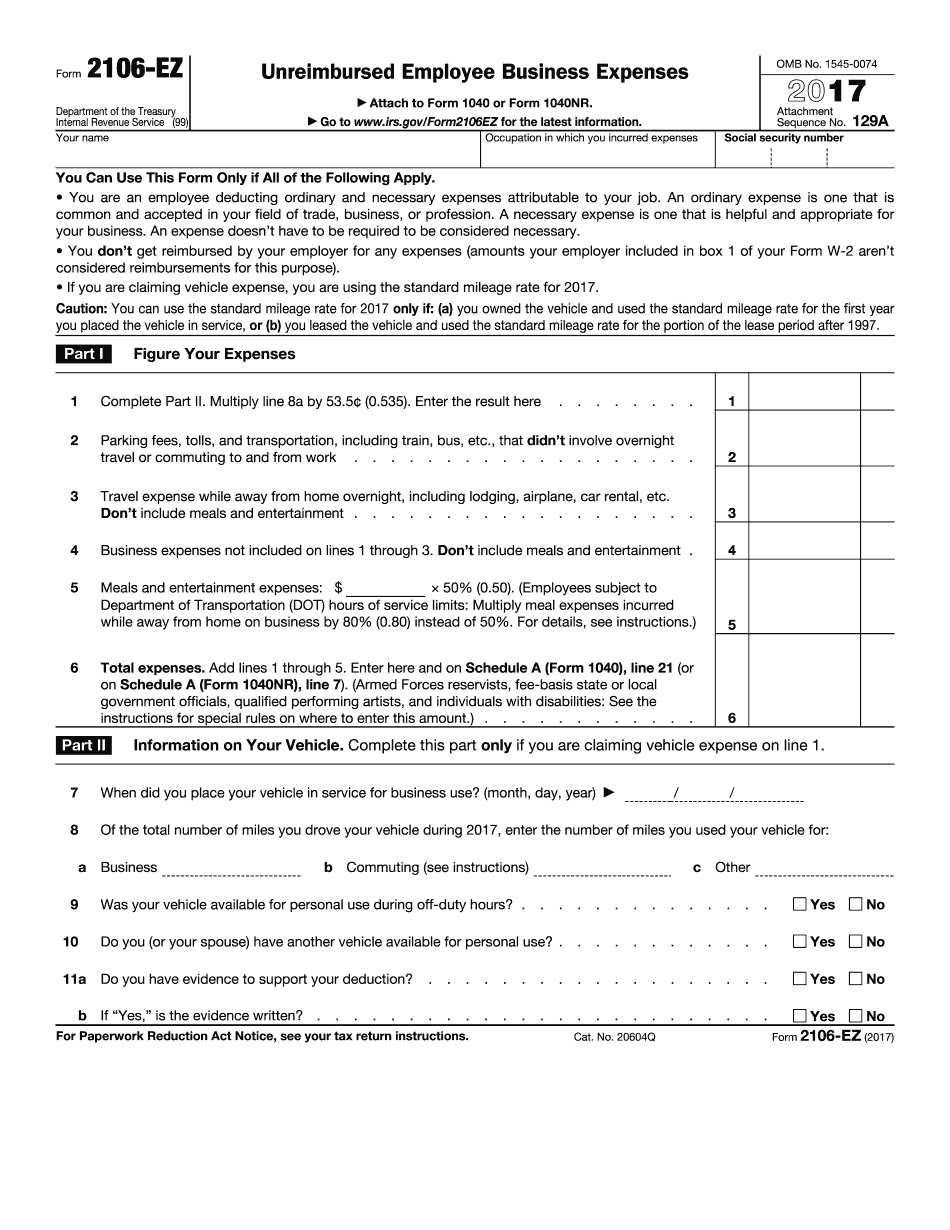

Printable Form 2106-EZ Sacramento California: What You Should Know

Ca.gov/forms or e-file. You will also need your 531-F10, Income from Farming or Fishing Interest If you are employed by an agricultural business and your wages are paid to the owner in a form other than by the employer's regular payroll system, you may be able to get the wages in another way, but that depends on the owner. The owner may collect or withhold wages in several ways, including: Employee Form or Statement to Report Wages Received in a Form for Which Wage Calculation Is Not Provided or Payroll Service Provider You can find out how to get information about your wages by sending a letter to your employer. Wages You Paid in a Form Other Than By Payroll If you paid wages to the owner in a form other than by payroll, pay the tax on the total amount, not just the amount on which you paid income tax. If you paid wages in a separate account from your other wages (i.e., not paid automatically), make sure to include those wages on W-2 form. Wages You Paid in an Account in Which Wages Are Held by a Payroll Service Provider If you paid wages to the owner in an account in which wages are held by a payroll service provider, you may be able to get the wages in another way, but that depends on the employer. The payroll service provider may or may not withhold tax in connection with your wages. Families Filing Joint Returns If you and your spouse are filing a joint return and the workweek is 6 or fewer hours, for more than 3 months in a calendar year, and the wages paid are more than 700, the total wages for the year shall be taxed at 10%. If your spouse has income subject to the standard deduction and you and your spouse file a joint return and the workweek is 6 or fewer hours per business day, for more than 3 months in a calendar year, and the wages paid are more than 50,000 (and the wages paid were more than 20,000 for any calendar year), the total wages for the year shall be taxed at 17% (or a higher rate of taxation if the taxpayer's share of that amount is more than 12,400).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 2106-EZ Sacramento California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 2106-EZ Sacramento California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 2106-EZ Sacramento California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 2106-EZ Sacramento California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.